While searching for Chinese New Year fixed deposit promotions, I came across the above promotion advertised. The bank is offering structured deposit that offers up to 12.1% returns over 6 years. It sounds very attractive to me given the high interest rate.

- Structured Deposit Singapore

- Structured Deposit Research

- Structured Deposit Promotion

- Structured Deposit Wiki

As I am not familiar with structured deposit, I decided to do some further research on it.

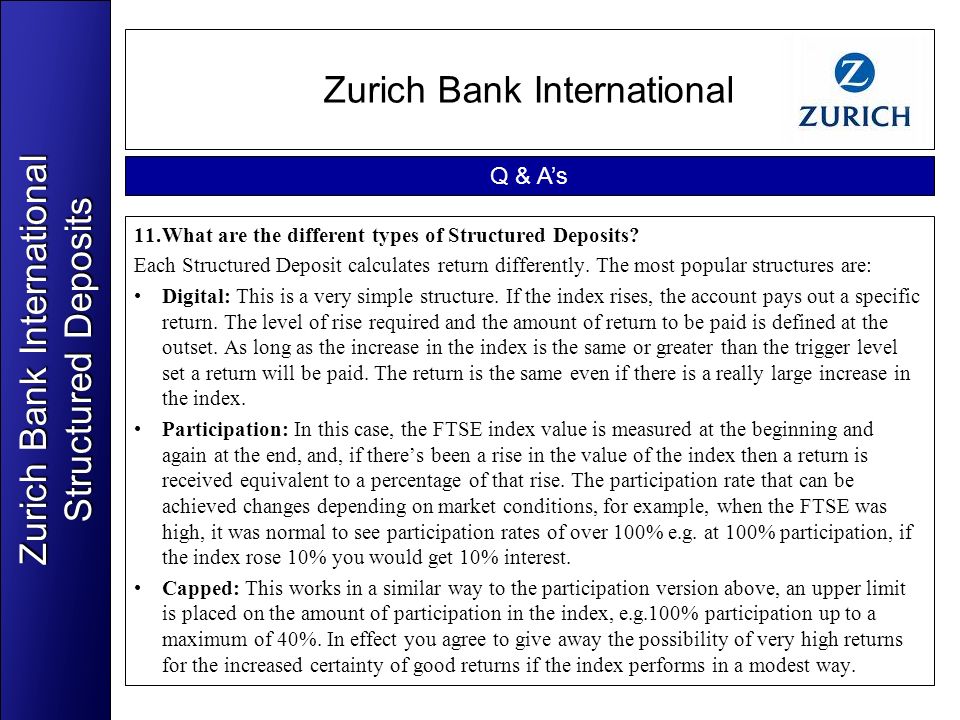

Structured Deposit Products. Structured deposits are savings accounts where the return is based on the performance of an index. Normally if the index is higher than it’s starting level on the maturity date you will receive an interest payment. If the index has dropped or stayed the same you would not receive any interest. A structured note is a debt obligation that also contains an embedded derivative component that adjusts the security's risk-return profile. The return on a structured note is linked to the. Structured deposits – Structured deposits are savings accounts, offered from time to time by some banks, building societies and National Savings & Investments, where the rate of interest you get depends on how the stock market index or other measure performs. If the stock market index falls, you will usually get no interest at all. Principal Protected Structured Investments and Non-Principal Protected Structured Investments (“Structured Investments”) Not a time deposit - Structured Investments is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

What is a structured deposit?

A structured deposit is actually a deposit that is combined with an investment product. The returns on the structured deposit will depend on the performance of the underlying financial asset, product or benchmark.

According to MoneySENSE website, structured deposits can be equity linked, bond linked, interest rate linked or credit linked. There are no further details on the above bank promotion what investment product it is linked with. If you happen to be interested, you should clarify with the banking officer prior to taking up the structured deposit product.

Benefits

- Structured deposits have the potential to offer higher returns compared to traditional fixed deposits.

Risk

- Structured deposits are riskier products than fixed deposits. The returns may be lower than expected.

- Structured deposits are not protected by the Deposit Insurance Scheme. If the bank defaults, we may lose all of our deposit.

This is a structured investment product involving derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice. The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. |

Investment involves risks. You should not invest in Structured Investments based on this page alone. You should read and understand the Bank's Conditions for Services and all of the offering documents including the relevant term sheet, Important Facts Statement and the Structured Investments Application Form, before deciding whether to invest in this product.

Key Product Features

- 100% principal protection – Principal Protected Structured Investments provides 100% protection at maturity.

- Various Linked Assets – provides you with an opportunity to gain a higher potential return via various linked assets such as interest rates or currency exchange rates.

- Flexible Investment Choices – You can choose HKD, USD, CNY or other designated currencies as the Investment Currency. The minimum investment amount is as low as HK$50,000 or its equivalent in other currencies. A wide range of investment periods are available for selection.

- Trading Channels – You can trade via designated branches and Internet Banking. Service hours: Mondays to Fridays, 9:00 a.m. – 5:00 p.m., except public holidays.

For details, please visit any of BOCHK branches or call Personal Customer Service Hotline at +852 3988 2388. Dafu casino slots.

Key Product Features

- Partial principal protection – Non-Principal Protected Structured Investments offers higher potential return but you have limited principal protection at maturity.

- Various Linked Assets – provides you with an opportunity to gain a higher potential return via various linked assets such as interest rates or currency exchange rates.

- Flexible Investment Choices – You can choose HKD, USD, CNY or other designated currencies as the Investment Currency. The minimum investment amount is as low as HK$50,000 or its equivalent in other currencies. A wide range of investment periods are available for selection.

- Trading Channels – You can trade via designated branches and Internet Banking. Service hours: Mondays to Fridays, 9:00 a.m. – 5:00 p.m., except public holidays.

Structured Deposit Singapore

For details, please visit any of BOCHK branches or call Personal Customer Service Hotline at +852 3988 2388.

Important Notice

Structured Deposit Research

The following risk disclosure statements cannot disclose all the risks involved. Prior to trading or investment, you should collect and study the information required for your investment. You should take your own independent review and seek independent professional advice, if necessary, on whether this product is suitable for you in light of your risk appetite, financial situation, investment experience, investment objectives and investment horizon. If you are uncertain of or have not understood any aspect of the following risk disclosure statements or the nature and risks involved in trading or investment, you should seek independent advice.

Risk Disclosure Statement

Principal Protected Structured Investments and Non-Principal Protected Structured Investments (“Structured Investments”)

Money apps for iphone. Here are the 40 different games that pay you real cash: 1. Source: Google Images. Love playing brain games like trivia, scrabble or word games? If so, you will fall in love with this money. Paid Game Player. Corporation Master. 50 Best iPhone games to make your commute 97% better Mark Delaney. But for our money, the best is still the old one. Sure, visually, it doesn't hold a cotton candy - er, candle - to the newer.

- Not a time deposit - Structured Investments is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

- Derivatives risk - Structured Investments is embedded with a European digital currency option which can only be exercised on the final fixing date if the specified condition for exercise is satisfied, in which case you may either receive the interest amount calculated at a higher interest rate, or otherwise, you will receive the interest amount calculated at a lower interest rate. The interest amount is therefore unknown in advance.

- Limited potential gain - The maximum potential gain is limited to the interest amount calculated at the higher interest rate as prescribed in the term sheet of this product.

- Principal protection at maturity only (only applicable to Principal Protected Structured Investments - Target Rate Investment) - The principal protection feature is only applicable if the Target Rate Investment is held to maturity.

- Not necessarily principal protection (only applicable to Non-Principal Protected Structured Investments - Non-Principal Protected Target Rate Investment) - Subject to the movements in the exchange rate of the currency pair, you may have only limited principal protection even if the Non-Principal Protected Target Rate Investment is held to maturity. You could lose part of your principal amount.

- Not the same as buying any currency of the currency pair - Investing in Structured Investments is not the same as buying any currency of the currency pair directly.

- Market risk - The return on Structured Investments is dependent on movements in the exchange rate of the currency pair. Currency exchange rates may move rapidly and are affected by a number of factors including, national and international financial, economic, political and other conditions and events and may also be subject to intervention by central banks and other bodies.

- Liquidity risk - Structured Investments is designed to be held till maturity. Once the transaction for this product is confirmed, you will not be allowed to early withdraw or terminate or transfer any or all of your investment before maturity.

- Credit risk of the Bank - Structured Investments is not secured by any collateral. If you invest in this product, you will be taking the credit risk of the Bank. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your principal amount and the potential interest amount.

- Currency risk - If the investment currency is not your home currency, and you choose to convert it back to your home currency upon maturity, you should note that exchange rate fluctuations may have an adverse impact on, and the potential loss may offset (or even exceed), the potential return of the product.

- RMB Conversion Limitation Risk - RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies.

(Only applicable to Individual Customers) RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

(Only applicable to Corporate Customers) RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance. - No secondary market - Structured Investments is not a listed security. There is no secondary market for you to sell the Structured Investments prior to its maturity.

- Not covered by Investor Compensation Fund - Structured Investments is not covered by the Hong Kong Investor Compensation Fund.

Structured Deposit Promotion

New casinos online 2019.

This page is issued by Bank of China (Hong Kong) Limited. Its contents have not been reviewed by any regulatory authority in Hong Kong.

Structured Deposit Wiki

- Quick Link